Credit Repair, Credit Scores, and Loans

Whether you’re a civilian or military member, most lenders require a minimum credit score of 620 to 640 to receive approval on a loan. In this article, you’ll learn more about how credit works for veterans, potential loan options, and how to repair a credit score to meet your financial goals.

First, Research All of Your Options.

Before we dive into credit scores and how it works. Let’s talk about the potential uses of a credit score, acquiring a loan. Understanding all of your options when seeking a loan is key to getting the best deal possible. Even veterans with fantastic credit and a 20% down payment may benefit from comparison shopping between conventional and VA loans.

Federal Benefits — Personal or Business?

Interested in buying a home? Veterans are eligible for VA home loans, which often require no down payment, no mortgage insurance, and have flexible underwriting requirements. An excellent resource to look into is the Veterans Benefits Administration website.

Ready to start a business? SBA 504 loans are designed to help small businesses owners purchase commercial real estate and equipment. There are also grants, loans, and business development programs backed by the U.S. Small Business Administration. Prospective entrepreneurs look into financing by searching the Small Business Administration’s Office of Veterans Business Development website.

Assess Your Finances.

Consider all factors beyond your status as a veteran when making money decisions. The right choice for you will align with your current financial situation and goals. What are your financial plans for the next 6 months to a year? What financial habits are you looking to strengthen or stop? Make sure you’re financial goals and habits are leading you in the right direction.

Understanding Your Credit Score.

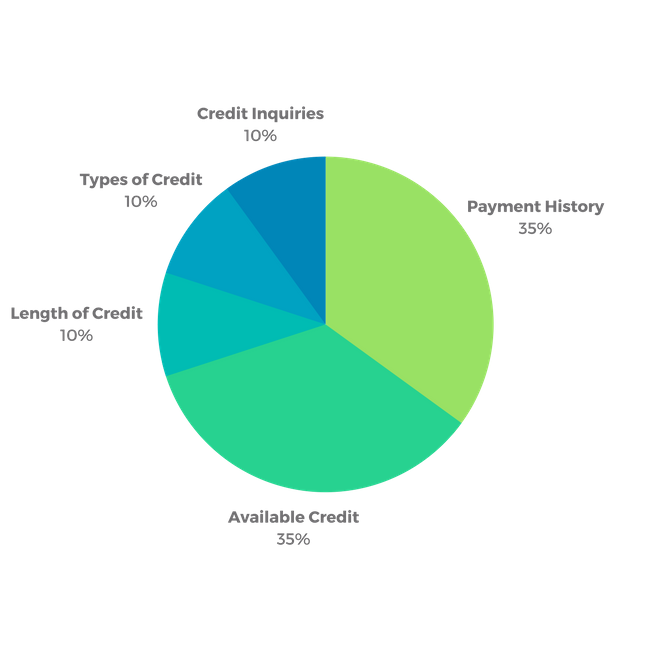

Part of assessing your financial plan includes reviewing your current credit score. The Fair, Isaacs Corporation, also known as FICO, created an algorithm for all three major credit agencies to use when calculating credit scores. This method creates your credit score by reviewing five different categories, with each category weighted. See below for details:

Credit Score Categories — Let’s Talk About Payment History.

Your payment history affects your credit score the most out of all other areas. The scoring algorithm determines if the borrower’s payments were on time and if they weren’t, how late they were. Late payments are categorized by more than 30 days late, more than 60 and more than 90. For each category, the algorithm drops the score more.

Where Does Available Credit Come In?

Your available credit is determined based on the number of outstanding credit accounts you have compared to the credit limit assigned to each account. The ideal amount of credit to use is around 30 percent of any credit limit. Scores typically improve when having a balance around this percentage. However, if an account has a zero balance, it will have little impact on your score.

Keep in mind, having a balance of more than 30 percent will result in your credit score falling.

Quick Credit Repair Options

The quickest way to repair credit scores is to focus on available credit and payment history. Make sure credit payments are consistently on time or paid no later than 30 days past due. Paying outstanding credit balances down to 30 percent of the available credit will help, too.

No matter what your situation, Go Clean Credit has a solution. We have many credit repair programs that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a one size fits all model and we tailor your needs to the right program. Help is just a free phone call away or you can fill out an appointment request.

Contact Go Clean Credit to schedule a free consultation today.