What does a credit score of 590 mean? Is a credit score of 590 good or bad?

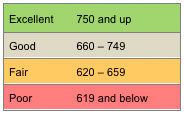

A credit score of 590 is considered “Poor.” In fact, any credit score below 619 can really take a toll on a person’s life – and not in a good way. The effects can be worse than one might think.

A credit score of 590 is considered “Poor.” In fact, any credit score below 619 can really take a toll on a person’s life – and not in a good way. The effects can be worse than one might think.

In this post, we’ll share what having a credit score of 590 means for home loans, car loans and credit cards. Plus, we’ll share how to improve a 590 credit score. Getting loans with a credit score of 590 is a tough, uphill trek—but if you know how to improve your credit score of 590, you’ll be in a better place to finance a home or car.

Credit Score of 590: Car Loans

Buying a car with a credit score of 590 is possible, but higher interest rates are always given to people with bad credit. What is the interest rate for a credit score of 590 on an auto loan?

First, let’s take the average amount borrowed by car buyers: $27,000 according to Melinda Zabritski, Experian’s senior director of automotive credit. Now, let’s factor in the 3 common types of auto loans available to us in myFICO’s loan savings calculator: 36-month new auto loan, 48-month new auto loan and a 60-month new auto loan.

Let’s take a look at how much more a car costs for someone with a credit score of 590 compared to a credit score of 690.

| Loan Type | Credit Score | Rate | Payment | Added Cost |

| 36-month new auto | 690 | 4.59% | $788 | $0 |

| 590 | 13.65% | $918 | $4,680 | |

| 48-month new auto | 690 | 4.61% | $617 | $0 |

| 590 | 13.68% | $733 | $5,568 | |

| 60-month new auto | 690 | 4.65% | $505 | $0 |

| 590 | 13.74% | $625 | $7,200 |

Can a credit score of 590 get a car loan? As the chart above shows, getting an auto loan with a 590 credit score is going to cost you a lot more. On a 36 month new auto loan, it’ll cost you $4,680 more. On a 48 month, $5,568 more. On a 60 month auto loan, it will cost you a whopping $7,200 more.

In other words, if your scored changed to a 690, you would save thousands of dollars on your loan. Don’t you think it’s worth a few hundred dollars toward credit repair before you take a test drive? Contact Go Clean Credit to get started.

Credit Score of 590: Credit Cards

What’s the best credit card for a score of 590? Unfortunately, your options are limited.

The general guidelines with credit cards is that any score above 600 may qualify for an unsecured card. If you have a credit score of 590, then you will only qualify for a secured credit card and will be required to make a minimum deposit in order to open your credit card. Go Clean Credit continually evaluates credit offerings and currently recommends these Secured Cards for people with a credit score of 590.

We have seen up to a 40 point increase in credit score just by opening one of these cards. What happens to your APR for a credit score of 590? Here’s a chart illustrating the differences between annual fees and interest rates between someone with good credit and a credit score of 590.

| Card Type | Score | Rate | Balance | Added Cost |

| Platinum | 720-850 | 4% | $5,000 | $0 |

| 700-719 | 6% | $5,000 | $362 | |

| Gold | 675-699 | 8% | $5,000 | $774 |

| 620-674 | 10% | $5,000 | $1,250 | |

| Standard | 590 Credit Score | 16% | $5,000 | $3,240 |

Credit Score of 590: Home Loans

Let’s say you are a first time home buyer with a credit score of 590. Can a credit score of 590 buy a house?

For most mortgages you need to be above a 620 credit score, but there are a few loans out there that go down to 590 for FHA. But then other parameters get harder (life debt to income) so it makes it pretty hard to qualify below 620.

Let’s say that you may qualify for a FHA loan with a credit score of 590, but as we can see in the charts below, a low FICO score increases the amount of money you will end up spending on a loan throughout the course of its life. If your FICO score is below a 560, most lenders will not even consider offering you a jumbo loan for a FICO score that low.

Note: The 30-year fixed jumbo home mortgage APR’s are estimated based on the following assumptions. FICO scores between 620 and 850 (500 and 619) assume a Loan Amount of $300,000, 1.0 (0.0) Points, a Single Family – Owner Occupied Property Type and an 80% (60-80%) Loan-To-Value Ratio.

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4.31% | $1,487 | $0 |

| 700-719 | 4.53% | $1,526 | $14,040 | |

| Moderate | 675-699 | 4.71% | $1,558 | $25,560 |

| 620-674 | 4.93% | $1,597 | $39,600 | |

| Bad | 590 Credit Score | 5.36% | $1,676 | $68,040 |

So can a credit score of 590 get a mortgage? Perhaps. But getting a mortgage with a credit score of 590 will add an extra $68,040 over the course of the loan than someone with a 721 credit score. The interest rate for a credit score of 590 will increase the monthly mortgage payment by $222 more than someone with a score 95 points higher, at a credit score of 675.

How To Improve A Credit Score of 590

Just how bad is a credit score of 590? As we’ve seen in the sections above, this score impacts every aspect of your financial life. Mortgages, auto loans and credit card interest rates are all dramatically higher than they would be if you had moderate credit.

If you would like to improve your credit score of 590, there are a few ways you can go about it.

1) Read this blog post on How To Improve Your Credit Score In 30 Days. We list simple tips in this blog post like paying down revolving balances to less than 30% and other tips that will improve your score quickly.

2) Read this blog post on what NOT to do when repairing credit. The last thing you want to do is move backwards in your efforts to improve your credit situation.

3) If you seriously need to improve your credit score in 30 days, you will benefit by enlisting the help of a credit repair company like Go Clean Credit. To learn more about our credit repair programs, please contact us.

No matter what your situation, Go Clean Credit has a solution. We have many credit repair programs that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a once size fits all model and we tailor your needs to the right program, but most people can start for just $99 per month.

We have fixed price programs that get you back on track in as little as 5 months, debt resolution solutions, programs geared toward people who have had recent short sales or foreclosures and many others. Help is just a free phone call away or you can fill out an appointment request. Contact Go Clean Credit to schedule a free consultation today.