Is a credit score of 565 good or bad? What does a credit score of 565 mean?

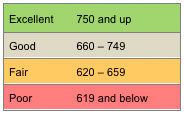

Brace yourself for some bad news… If you have a credit score of 565, you have what’s considered “poor” credit and are in need of credit repair ASAP. As a general rule, credit scores below 619 receive the worst interest rates on home loans, auto loans and credit. The effects can really take a toll on a person’s life – and it might be worse than you think.

Brace yourself for some bad news… If you have a credit score of 565, you have what’s considered “poor” credit and are in need of credit repair ASAP. As a general rule, credit scores below 619 receive the worst interest rates on home loans, auto loans and credit. The effects can really take a toll on a person’s life – and it might be worse than you think.

What does having a credit score of 565 mean for home loans, car loans and credit cards? How do you improve a 565 credit score? Is it possible to get a loan with a credit score of 565? We will answer all of those questions and more—so read on.

Credit Score of 565: Car Loans

Buying a car with a credit score of 565 is a possibility, but you’re most likely going to have to deal with an extremely high interest rate. People with bad credit – if approved for a loan – are always offered higher interest rates than someone with a credit score even 80 points higher than their score. What is the interest rate for a credit score of 565 on a car loan?

The average amount borrowed by car buyers is $27,000, according to Melinda Zabritski, Experian’s senior director of automotive credit. When you factor in the three common types of auto loans available in myFICO’s loan savings calculator — 36-month new auto loan, 48-month new auto loan and a 60-month new auto loan — you’ll get a good idea of how much more an auto loan will cost for someone with a credit score of 565 versus a credit score of 645.

Let’s take a closer look:

| Loan Type | Credit Score | Rate | Payment | Added Cost |

| 36-month new auto | 645 | 9.306% | $862 | $0 |

| 565 | 14.767% | $933 | $2,536 | |

| 48-month new auto | 645 | 9.327% | $676 | $0 |

| 565 | 14.776% | $748 | $3,469 | |

| 60-month new auto | 645 | 9.396% | $566 | $0 |

| 565 | 14.788% | $639 | $4,419 |

So you’re saying that an 80-point difference in credit scores results in a difference of $4,419—for the same car?

Yes, that’s exactly right. Getting a car loan with a 565 credit score is going to cost you a lot more. On a 36-month new auto loan, it’ll cost you $2,536 more. On a 48-month, $3,469 more. On a 60-month auto loan, it will cost you a whopping $4,419 more.

In other words, if your scored changed to a 645—just an 80-point improvement—you would save thousands of dollars on your loan. It is completely worth it to pay a company like Contact Go Clean Credit to restore your credit before you take a test drive.

Credit Score of 565: Home Loans

Let’s say you are a first-time homebuyer with a credit score of 565. Can a credit score of 565 buy a house?

For most mortgages you need to be above a 620 credit score, but there are a few loans out there that go down to 565 for FHA. However, other parameters get harder (life debt to income), so it makes it pretty hard to qualify below 620.

Let’s say that you may qualify for a FHA loan with a credit score of 565. As you’ll see in the charts below, a low FICO score increases the amount of money you will end up spending on a loan throughout the course of its life.

Note: The 30-year fixed jumbo home mortgage APRs are estimated based on the following assumptions. FICO scores between 620 and 850 (500 and 619) assume a Loan Amount of $300,000, 1.0 (0.0) Points, a Single Family – Owner Occupied Property Type and an 80% (60-80%) Loan-To-Value Ratio.

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4.31% | $1,487 | $0 |

| 700-719 | 4.53% | $1,526 | $14,040 | |

| Moderate | 675-699 | 4.71% | $1,558 | $25,560 |

| 620-674 | 4.93% | $1,597 | $39,600 | |

| Bad | 565 Credit Score | 5.90% | $1,780 | $105,480 |

So, can a credit score of 565 get a mortgage? Maybe. But is it worth it?

Getting a mortgage with a credit score of 565 will add an extra $105,480 over the course of the loan than someone with a 721 credit score. The interest rate for a credit score of 565 will increase the monthly mortgage payment by $183 more than someone with a score 75 points higher, at a credit score of 640.

Credit Score of 565: Credit Cards

What’s the best credit card for a score of 565? Unfortunately, if your credit score is a 565, you will not qualify for an unsecured credit card.

In other words, you will need to make a deposit to open a credit card account.

Any credit score above 600 may qualify for an unsecured card – depending on the type of credit card you’re applying for. But if your credit score starts with a “5” and ends in two numbers (“65”), then you will only qualify for a secured credit card.

What’s a secured credit card? It means that you will be required to make a minimum deposit in order to open your credit card. Go Clean Credit continually evaluates credit offerings and currently recommends these Secured Cards for people with a credit score of 565.

We have seen up to a 40-point increase in credit score just by opening one of these cards. What happens to your APR for a credit score of 565? Here is a chart illustrating the differences between annual fees and interest rates between someone with good credit and someone with a credit score of 565.

| Card Type | Score | Rate | Balance | Added Cost |

| Platinum | 720-850 | 4% | $5,000 | $0 |

| 700-719 | 6% | $5,000 | $362 | |

| Gold | 675-699 | 8% | $5,000 | $774 |

| 620-674 | 10% | $5,000 | $1,250 | |

| Standard | 565 Credit Score | 23% | $5,000 | $7,856 |

How To Improve A Credit Score of 565

Just how bad is a credit score of 565? As we’ve seen in the sections above, this score impacts every aspect of your financial life. Mortgages, auto loans and credit card interest rates are all dramatically higher than they would be if you had moderate credit.

If you would like to improve your credit score of 565, there are a few ways you can go about it.

1) Read this blog post on How To Improve Your Credit Score In 30 Days. We list simple tips in this blog post like paying down revolving balances to less than 30% and other tips that will improve your score quickly.

2) Read this blog post on what NOT to do when repairing credit. The last thing you want to do is move backwards in your efforts to improve your credit situation.

3) If you seriously need to improve your credit score in 30 days, you will benefit by enlisting the help of a credit repair company like Go Clean Credit. To learn more about our credit repair programs, please contact us.

No matter what your situation, Go Clean Credit has a solution. We have many credit repair programs that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a once size fits all model and we tailor your needs to the right program, but most people can start for just $99 per month.

We have fixed price programs that get you back on track in as little as 5 months, debt resolution solutions, programs geared toward people who have had recent short sales or foreclosures and many others. Help is just a free phone call away, or you can fill out an appointment request. Contact Go Clean Credit to schedule a free consultation today.