Bad credit – two of the most dreaded words in the English language. Bad credit can really take a toll on a person’s life – and not in a good way. In fact, the effects can be worse than one might think.

Having bad credit can make it next to impossible to attain a new car, an apartment, a personal loan or even a home. Even something as simple as getting a new credit card will be out of the question for a consumer with a negative credit history.

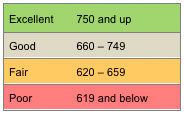

The most widely used credit scores are FICO® scores, the credit scores created by Fair Isaac Corporation. Lenders can buy FICO® scores from all three major credit reporting agencies, Equifax, Experian and TransUnion. FICO® scores range from 300-850 – higher is better.

The most widely used credit scores are FICO® scores, the credit scores created by Fair Isaac Corporation. Lenders can buy FICO® scores from all three major credit reporting agencies, Equifax, Experian and TransUnion. FICO® scores range from 300-850 – higher is better.

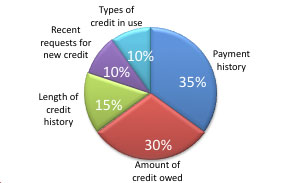

How you pay your bills and debt accumulation are the two most important factors in calculating your credit score. Your FICO® Credit Score is weighted as follows.

Even if you’ve been fortunate enough to be able to purchase a new home or a car with bad credit, you’re still being punished in some way for your low credit score. Usually, the penalty you’ll receive for bad credit is a higher interest rate than you would have received normally.

Lenders see you as a risk and one of the downfalls of this is having to pay more in the long run simply because your credit score is low. What does all of this really mean? To put it simply, it means that having good credit and receiving a good interest rate could end up saving you hundreds or even thousands of dollars on your next loan. THE LOWER YOUR CREDIT SCORE THE HIGHER YOUR INTEREST RATE.

Tired of paying the price of bad credit?

Go Clean Credit can help! We have the experience and know-how to help you rise above your past mistakes and turn your future into one where your great credit score gets you the things you want at a fair interest rate.

Auto Loans with Bad Credit

The 36-month new auto loan APRs are estimated based on the following assumptions. A Loan Amount of $25,000, 36 months and Interest rates are fixed for the term of the loan. (Variable rate loans may be available but are not usually beneficial to a consumer in a low interest rate environment.)

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 5.30% | $753 | $0 |

| 700-719 | 6.83% | $770 | $612 | |

| Moderate | 675-699 | 8.78% | $792 | $1,404 |

| 620-674 | 12.36% | $835 | $2,952 | |

| Bad | 560-559 | 18.20% | $906 | $5,508 |

| 500-559 | 19.23% | $919 | $5,976 |

As the chart clearly shows above, getting an auto loan with bad credit can end up costing you thousands of dollars more than it would have with good credit. Higher interest rates are always given to people with bad credit, but Go Clean Credit doesn’t want you to be punished anymore. Ask us how you can get a free consultation and learn what we can do to get you lower interest rates on your car loan today!

Credit Cards with Bad Credit

As the chart below clearly shows, having good credit or bad credit can mean saving or losing hundreds, or even thousands of dollars. Why is this, you ask? It’s because when you have bad credit, you end up paying a lot more in interest. If a person with bad credit gets a credit card, chances are that the annual fees and interest rate are much higher than it would be for someone with good credit. It can be hard for someone with bad credit to recover from having to pay such high fees on their credit card. Instead of wasting your money on a credit card for people with bad credit, all you have to do is sign up here and we will help you get a lower interest rate than you could get on your own.

| Card Type | Score | Rate | Balance | Added Cost |

| Platinum | 720-850 | 4% | $5,000 | $0 |

| 700-719 | 6% | $5,000 | $362 | |

| Gold | 675-699 | 8% | $5,000 | $774 |

| 620-674 | 10% | $5,000 | $1,250 | |

| Standard | 560-559 | 16% | $5,000 | $3,240 |

| 500-559 | 23% | $5,000 | $7,856 |

Mortgages with Bad Credit

How bad credit affects home loans –

The 30-year fixed jumbo home mortgage APR’s are estimated based on the following assumptions. FICO scores between 620 and 850 (500 and 619) assume a Loan Amount of $300,000, 1.0 (0.0) Points, a Single Family – Owner Occupied Property Type and an 80% (60-80%) Loan-To-Value Ratio.

Take a look at the chart below. Notice how a low FICO score increases the amount of money you will end up spending on a loan throughout the course of its life. If your FICO score is below a 560, most lenders will not even consider offering you a jumbo loan for a FICO score that low. If you want to save money and stay away from bad credit mortgages, sign up here!

| Credit | Score | Rate | Payment | Added Cost |

| Excellent | 720-850 | 4.31% | $1,487 | $0 |

| 700-719 | 4.53% | $1,526 | $14,040 | |

| Moderate | 675-699 | 4.71% | $1,558 | $25,560 |

| 620-674 | 4.93% | $1,597 | $39,600 | |

| Bad | 560-559 | 5.36% | $1,676 | $68,040 |

| 500-559 | 5.90% | $1,780 | $105,480 |