In today’s world, your credit reports and scores have considerable importance (for better or worse), and can either save you money or cost you money. Who is the Oz behind the curtain of the credit industry that is responsible for your credit?

To help bring a little clarity to the confusing world of credit reports, here are some facts about the credit repair industry.

Fact: Each MONTH, 10,000 data furnishers (creditors) provide info on 1.3 billion consumer “trade lines.”

Equifax, Experian, and TransUnion each have more than 200 million files on consumers. In a typical month, they receive updates from approximately 10,000 information “furnishers,” which are the entities that supply data on consumers. The furnishers do this on more than 1.3 billion “trade lines,” which are individual information sources on a consumer report such as a consumer’s accounts for a car loan, mortgage loan, or credit card.

No wonder why credit reports can have material errors before credit repair.

Source: CFPB Report, 12/12

Fact: Studies range from 25% to 79% of credit reports have material errors

In February of 2013, 60 Minutes ran a report called “40 Million Mistakes: Is Your Credit Report Accurate?” The study indicates that as many as 40 million consumers have a mistake on their credit report. Plus, it’s hard to get them fixed.

Here’s the video.

Fact: Roughly 77 million Americans, or 35 percent of adults with a credit file, have a report of debt in collections.

These adults owe an average of $5,178. Debt in collections involves a nonmortgage bill such as a credit card balance, medical or utility bill that is more than 180 days past due and has been placed in collections. 5.3 percent of people with a credit file have a report of past due debt, indicating they are between 30 and 180 days late on a nonmortgage payment.

Source: Urban Institute

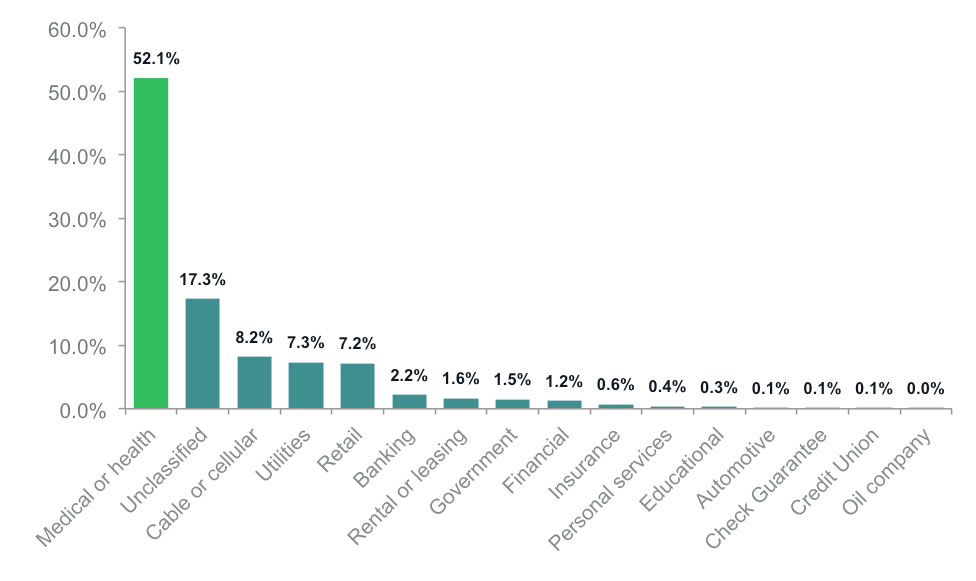

Fact: Roughly half of all collections tradelines that appear on credit reports are reported by debt collectors seeking to collect on medical bills claimed to be owed to hospitals and other medical providers.

These medical debt collections tradelines affect the credit reports of nearly one-fifth of all consumers in the credit reporting system.

Source: CFPB

Fact: More than half of the trade lines in the credit bureau databases are supplied by the credit card industry.

Credit reporting companies get their information from a variety of industries but more than half of the account information is supplied by credit card companies. Specifically, 40 percent comes from bank cards, such as general credit cards, and 18 percent comes from retail credit cards. Only 7 percent comes from mortgage lenders or servicers, and only 4 percent comes from auto lenders.

Source: CFPB Report

Fact: More than a third of disputes have to do with collections

In 2011, consumers reached out to the credit reporting companies roughly 8 million times, resulting in disputes of 32 to 38 million items in their credit files. Almost 40 percent of the disputes relate to debt in collections, and debt in collections is five times more likely to be disputed than mortgage information. According to the industry, some of this may have to do with consumers’ incentive to dispute any negative information on their reports.

Source: CFPB

Fact: Fewer than one in five people obtain copies of their credit report each year

The most effective way for consumers to identify errors in their reports is to obtain copies and review them. But only about 44 million consumers per year, or about one in five, obtain copies of their files.

Source: CFPB

Fact: The top 10 data furnishers provide 57 percent of the trade lines coming into the credit reporting companies.

Most information contained in credit files comes from a small number of large banks and other financial institutions. In fact, the top 50 furnishers provide 72 percent. And the top 100 furnishers provide 76 percent.

Who knew that most information contained in credit reports comes from a few large companies?

Source: CFPB

Fact: An average of 15 percent of consumer disputed items are addressed internally by the credit reporting companies

Most complaints and disputes are forwarded to the furnishers that provided the original information. Why is that a problem? With 85 percent of all disputes and complaints being passed on to the furnishers, the CFPB report found that “the documentation consumers mail in to support their cases may not be getting passed on to the data furnishers for them to properly investigate and report back to the credit reporting company.”

Yikes. All of these facts about the credit repair industry shine some light on the confusing world of credit reports, and the types of volume that happens each month in credit disputes.

No matter what your situation, Go Clean Credit has a solution. We have many credit repair programs that are available to help you overcome your credit situation and place you back on the path to financial success. Real credit restoration is not a once size fits all model and we tailor your needs to the right program, but most people can start for just $99 per month.

We have fixed price programs that get you back on track in as little as 5 months, debt resolution solutions, programs geared toward people who have had recent short sales or foreclosures and many others. Help is just a free phone call away or you can fill out an appointment request. Contact Go Clean Credit to schedule a free consultation today.